Jupiter Wagons Ups Stake in Electric Mobility to 75%, Eyes Railway Growth

Jupiter Wagons Limited: Overview

Jupiter Wagons known as Commercial Engineers & Body Builders Company Ltd is involved in business of metal fabrication of load bodies for commercial vehicles, rail freight wagons and its components. The rail mobility business is for open, flat, covered, defence wagons and wagon accessories, passenger coach accessories, wheel sets and track solutions. It also makes water tankers, BESS container, data center containers, marine containers, brake systems and discs, etc. Railway wagons contribute about 84% of the company’s revenue and commercial vehicle load bodies and components about 11%. The order book of company is ₹7000+ crores with the clientele of Tata Motors, Mahindra, JSW Steel, Adani Ports and Logistics, etc. The company has total 12 manufacturing facilities in India, with a production capacity of 8000 wagons per year.

Latest Stock News (7 Jan 2025)

Jupiter Wagons Ltd. has its subsidiary Jupiter Electric Mobility Pvt Ltd. with stake of 60% and on December 31st Jupiter Wagons Ltd has increased their stake by 15% to 75% of its paid-up share capital. Jupiter Wagons with other railway stocks has risen up by 7%-10%, hoping a recovery in central government capex and major announcements from the Union Budget for railway sector.

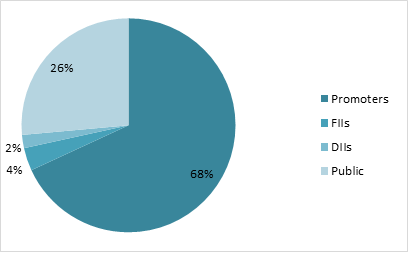

Shareholding Pattern as on September 2024

Key Stats

| Market Cap | ₹20304 Crore |

| Revenue | ₹3877 Crore |

| Profit | ₹365 Crore |

| ROCE | 31.67% |

| P/E | 55.56 |

Peer Comparison

| Amt in ₹ Cr | MCap | Sales | PAT | ROCE | Asset Turn. | EV/EBITDA | D/E | P/E |

| Jupiter Wagons | 20304 | 3877 | 365 | 31.67% | 1.64 | 35.9 | 0.16 | 55.56 |

| Titagarh Rail | 14642 | 3967 | 304 | 24.97% | 1.47 | 28.94 | 0.21 | 48.2 |

| Jyoti CNC Auto | 30583 | 1620 | 274 | 21.22% | 0.72 | 69.4 | 0.17 | 111.4 |

| Texmaco Rail | 7582 | 4475 | 208 | 10.59% | 0.93 | 17.84 | 0.35 | 36.5 |

Financial Trends

| Amount in ₹ Cr | 2020 | 2021 | 2022 | 2023 | 2024 |

| Revenue | 127 | 82.9 | 105 | 123 | 87.9 |

| Expenses | 114 | 72 | 95.8 | 113 | 80.2 |

| EBITDA | 12.38 | 11.3 | 9.6 | 10.25 | 7.7 |

| OPM | 10% | 14% | 9% | 8% | 9% |

| Net Profit | 7.62 | 7.9 | 7.4 | 8.08 | 5.5 |

| NPM | 6.0% | 9.5% | 7.0% | 6.6% | 6.3% |

| EPS | 4.56 | 4.75 | 4.4 | 4.83 | 3.3 |

Stock Price Analysis

In terms of performance, Jupiter Wagons has shown a return of -5.71% in one day, -2.81% over the past month, and -2.14% in the last three months. Over the past 52 weeks, the shares have seen a low of ₹301 and a high of ₹748.05. As the railway industry in major eyesight, the stock has rallied great and the volume traded has increased compared to the past. There is some fluctuation in stock but before Union Budget there is a chance for rally in stock in short term.